New tax law increases need to support local organizations

While there remain a few hours in 2017, you might want to get charitable contributions in under the wire for tax purposes — and, of course, for the feeling of making a positive difference in your community.

However, federal lawmakers put some wrinkles in that process that could create complications for donors and shortfalls for their favorite charities.

The standard deduction (the amount people can subtract from their taxable income without itemizing deductions on their tax returns) is now $12,000 for individuals and $24,000 for married couples. Wealthy benefactors who give in large quantities to charity every year won’t be affected by this change because they itemize well above that $24,000 figure.

However, the new law could discourage smaller donors. Those donors might start “bunching” — making all their donations during certain years (and skipping others) to save as much as they can on their taxes.

Changes in the estate tax could also have ripple effects. Donating portions of their estates to charity to avoid huge tax bills for their survivors motivated numerous people to open their hearts and checkbooks. The tax once applied to estates valued at more than $5.49 million. The new law increases the exemption to $11.2 million.

Of course, for most residents of Yamhill County, worrying about the tax effect on an $11.2 million estate is a problem they would like to have. They are probably less concerned about changes in the tax law than providing warm blankets for cold children.

While changes regarding charitable donations in the tax law should be noted, the message here is that many worthy causes may end up taking in less money. After all, most people don’t give money to save money. They want to help their fellow human beings.

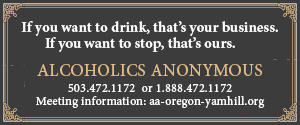

So use these last few moments of 2017 to be kind. The Yamhill County Gospel Rescue Mission, Henderson House, Juliette’s House, St. Vincent de Paul, Lutheran Community Services and Yamhill Community Action Partnership are among the agencies that will expand the reach of your dollars by acting locally. MacHub provides a central location where people can drop off used items to be resold so the profits can benefit local causes. And the Oregon Cultural Tax Credit program allows you to donate to local arts and heritage organizations, then to make a matching gift to the Oregon Cultural Trust that’s returned as a state tax credit — visit yamhillcountyculture.org/give-2 for more details on that.

The varieties of the tax laws can be perplexing, but in the end, it doesn’t really matter. We are defined by what we do and how much we care, regardless of how it looks on our tax forms. No matter what happens on the federal level, the heart of the community should beat true.

Comments